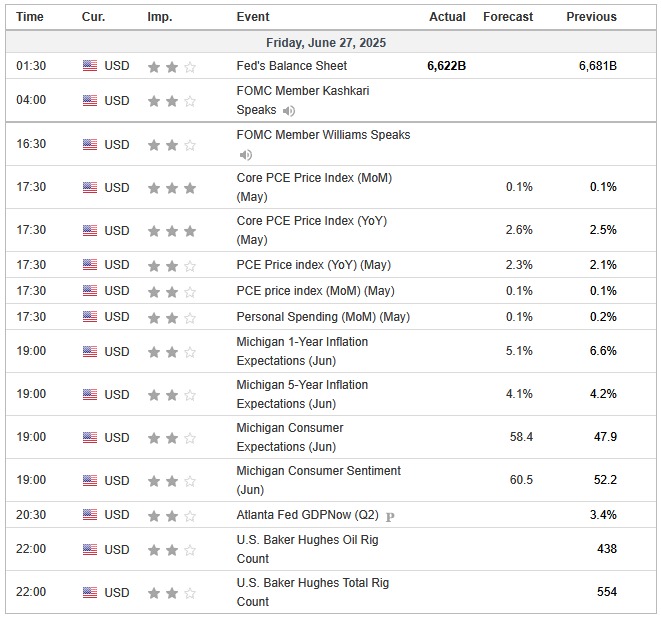

In the ever-evolving world of forex trading, keeping track of fundamental events is key to profitability. Today, June 27, 2025, the U.S. economy released a series of impactful indicators affecting USD pairs, interest rate outlooks, inflation expectations, and overall market sentiment. Let’s break down how these data points can shape short-term volatility and long-term strategy for traders using AI trading bots, scalping systems, or manual swing strategies.

The Fed’s Balance Sheet saw a reduction from 6,681B to 6,622B, signaling potential tightening or a reduction in liquidity. This can lead to a stronger dollar in the coming sessions. At the same time, FOMC members Kashkari and Williams are set to speak — which may provide further clues on the Federal Reserve’s interest rate trajectory.

Economic Data Highlights

| Event | Actual | Forecast | Previous |

|---|---|---|---|

| Fed’s Balance Sheet | 6,622B | — | 6,681B |

| Core PCE Price Index (MoM) (May) | 0.1% | 0.1% | 0.1% |

| Core PCE Price Index (YoY) (May) | 2.6% | 2.5% | — |

| PCE Price Index (YoY) (May) | 2.3% | — | 2.1% |

| PCE Price Index (MoM) (May) | 0.1% | 0.1% | — |

| Personal Spending (MoM) (May) | 0.1% | — | 0.2% |

| Michigan 1-Year Inflation Expectations | 5.1% | — | 6.6% |

| Michigan 5-Year Inflation Expectations | 4.1% | — | 4.2% |

| Michigan Consumer Expectations (June) | 58.4 | — | 47.9 |

| Michigan Consumer Sentiment (June) | 60.5 | — | 52.2 |

| Atlanta Fed GDPNow (Q2) | — | — | 4.3% |

| U.S. Baker Hughes Oil Rig Count | 438 | — | — |

| U.S. Baker Hughes Total Rig Count | 554 | — | — |

What This Means for Forex Traders

These figures reflect steady inflation and improving consumer confidence, which can boost USD strength in the short-term. While PCE data remains controlled, any hawkish tone from FOMC speakers could fuel a bullish rally in DXY and create short-term volatility across EUR/USD, GBP/USD, and USD/JPY pairs. Scalpers and AI trading bots can capitalize on rapid fluctuations using breakout strategies during high-impact news hours.

Why This Data Matters in 2025

With AI trading bots and automated forex systems becoming more precise, today’s economic releases allow bots to adapt to macroeconomic shifts instantly. Whether you’re a manual trader or running a bot like GPS Forex Robot, today’s CPI-aligned PCE data confirms a slightly dovish environment, opening opportunities in both trend following and range-bound setups.

FAQs

Q1: Which forex pairs are most impacted today?

Primarily USD-based pairs: EUR/USD, USD/JPY, GBP/USD, and gold (XAU/USD).

Q2: Does a drop in the Fed’s Balance Sheet affect forex?

Yes. A reduction in balance sheet usually supports USD strength due to liquidity tightening.

Q3: What’s the best way to trade these events?

Use AI bots or manual systems with tight spreads and real-time economic filtering, especially during NY session.

Q4: How often is PCE data updated?

PCE is released monthly and is one of the Fed’s preferred inflation gauges.

Relevant Post

Top 5 AI Trading Bots for Forex in 2025

Final Thoughts

June 27, 2025, delivered a data-rich day that could shape USD’s movement heading into Q3. Whether you’re using top forex bots of 2025 or trading manually, it’s clear that inflation remains under control, consumer sentiment is rebounding, and the Federal Reserve remains in focus. For traders, this is the time to refine setups, observe price action closely, and deploy bots that adapt to macro events.

Pingback: how to stay relevant as a trader in the AI age? 2025