What is Swing Trading?

Swing trading is a medium-term strategy that involves holding positions for a few days to several weeks. The goal? To capture “swings” in the market, riding trends at the start and exiting before they reverse.

Key Characteristics of Swing Trading

- Time Commitment: Requires moderate observation, making it ideal for those balancing trading with other responsibilities.

- Technical and Fundamental Analysis: Relies on chart patterns, technical indicators, and sometimes fundamental data to predict price movements.

- Trades Per Month: Swing traders typically place fewer trades, often ranging from 5 to 50 per month.

What is Day Trading?

On the flip side, day trading is a high-intensity, short-term strategy where trades are opened and closed within the same trading day. The goal is to capitalize on intraday price movements.

Key Characteristics of Day Trading:

- Time Commitment: Requires full-time dedication during market hours, as trades need constant monitoring.

- Quick Decision-Making: Relies heavily on technical analysis and real-time news to capitalize on short-lived market trends.

- Trades Per Day: Day traders place multiple trades daily, often exceeding 10 trades in one session.

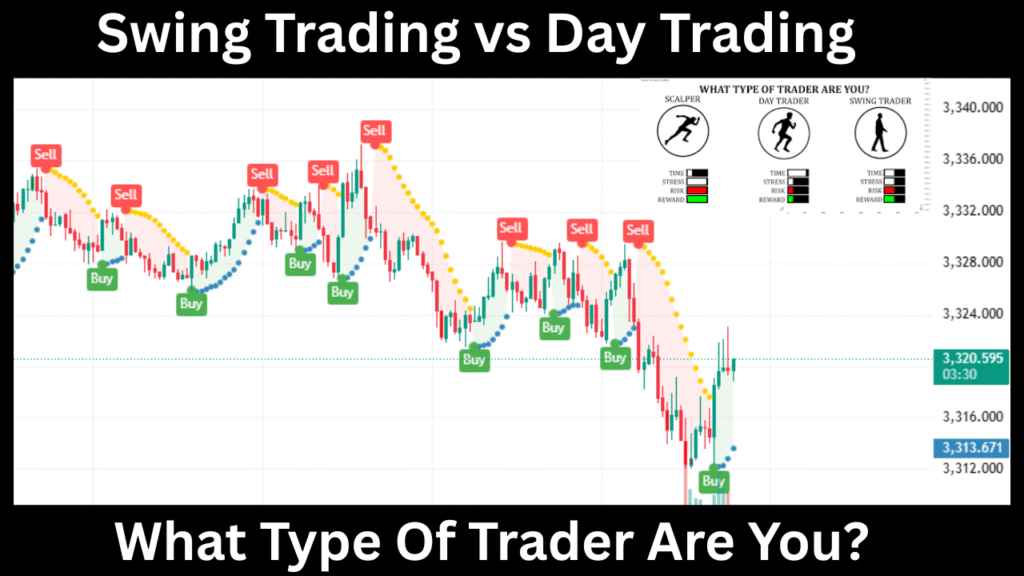

Swing Trading vs Day Trading – A Head-to-Head Comparison

| Aspect | Swing Trading | Day Trading |

|---|---|---|

| Duration of Trades | Days to weeks | Within the same day |

| Time Commitment | Requires less time daily | Requires full-time focus |

| Risk | Lower intraday risk | Higher due to frequent trades |

| Capital Requirement | Moderate | High, to meet margin requirements |

| Stress Level | Generally lower stress | Higher due to quick decisions |

| Profit Potential | Potentially steady over time | High but with greater fluctuation |

From the table above, swing trading is better suited to those with limited time, while day trading is an option for those seeking faster thrills with dedicated attention to market movements.

Pros and Cons of Swing Trading

Pros:

- Requires less daily attention, making it suitable for part-time traders.

- Lower transaction costs due to fewer trades.

- Allows for more thoughtful decision-making by analyzing broader trends.

Cons:

- Vulnerable to overnight risks, such as news that impacts the market before you can react.

- Slower profit accumulation compared to day trading.

Pros and Cons of Day Trading

Pros:

- No worrying about overnight risks since trades are completed intraday.

- Opportunity for quick profits on volatile markets.

- Immediate feedback, which can improve learning and strategy development.

Cons:

- Requires significant time and focus during trading hours.

- High transaction costs due to frequent trades.

- Emotional stress from rapid decision-making.

Who Should Choose Swing Trading?

Swing trading works well for:

- Full-Time Professionals: Those who can’t afford to monitor the markets throughout the day due to other commitments.

- Beginners: Those starting with trading often find swing trading less intimidating, providing more time to learn.

- Risk-averse Individuals: With fewer trades and longer holding periods, swing trading typically involves less risk than day trading.

Who Should Choose Day Trading?

Day trading might suit:

- Thrill-Seekers: If you thrive in high-pressure, fast-paced environments, day trading can be exhilarating.

- Full-Time Traders: Those with the flexibility and dedication to sit at the screen during market hours.

- Experienced Traders: Veterans often steer toward day trading as they can leverage their experience to make quick, accurate decisions.

Swing Trading vs Day Trading in Different Markets

Stocks

- Swing Traders can take advantage of stable trending stocks in bullish or bearish markets.

- Day Traders often focus on high-volume stocks with volatile price movements like tech giants or penny stocks.

Forex

- Swing Traders benefit from long trends influenced by macroeconomic events.

- Day Traders thrive during high-liquidity sessions, such as the London-New York overlap.

Cryptocurrency

- Swing Trading works well with crypto since prices often trend for days or weeks.

- Day Trading is an attractive option for crypto’s extreme intraday volatility.

Relevant Post

7 Ethics and Risks of Using AI in Forex Trading

Fraquently Asked Questions (FAQs) About Swing vs Day Trading

Which is more profitable, swing trading or day trading?

Both can be equally profitable with the right strategy. Swing trading offers steadier returns over time, while day trading has higher short-term earning potential but also carries higher risks.

Do I need more capital for swing trading or day trading?

Day trading generally requires higher capital due to margin requirements and frequent trading costs. Swing trading can be started with relatively lower capital.

Can I combine both strategies?

Yes! Some traders use swing trading for their broader portfolio and day trading as a separate venture for short-term gains.

Finding Your Perfect Fit

Still not sure whether you’re a swing trader or a day trader? You don’t have to rush the decision. Dip your toes into both strategies using a demo account or small capital to see what fits your lifestyle and goals.

Remember, successful trading depends not just on your strategy but also on discipline, risk management, and continuous learning.

0m79l6

eljwz8

coxcfv