What is AI in Forex Trading?

AI in forex trading involves advanced algorithms, machine learning (ML), and neural networks to analyze massive datasets and automate trading processes. These systems can predict market movements, manage risks, and execute trades faster and more accurately than human traders can.

Unlike human traders, who might take days to assess market patterns, AI-powered platforms like TradeZenith and SigmaForex AI analyze real-time and historical data in seconds. This speed and precision have placed AI at the forefront of the forex trading revolution.

But as progressive as this sounds, AI doesn’t come without its challenges. That’s why understanding its pros, cons, and potential future is vital for traders and companies alike.

The Benefits of AI in Forex Trading

1. Precision and Speed

AI can process colossal amounts of data in milliseconds, identifying patterns and trends that would take human traders hours or even days to recognize. This accuracy ensures AI systems can make better-informed trade decisions.

2. Eliminating Human Error

We’ve all heard stories of traders making emotional or impulsive decisions under pressure. AI, by design, operates without emotions, ensuring that trades follow data-driven logic rather than gut feelings.

3. Risk Management

AI excels in assessing risks. Advanced tools provide real-time alerts and offer suggestions to minimize potential losses, helping traders protect their capital.

4. Round-the-Clock Trading

AI-powered systems can trade 24/7 without fatigue. For global forex markets that operate across all time zones, this is a game-changer.

The Ethical Dilemmas AI Brings to Forex Trading

Like any innovation, AI introduces ethical challenges. Here are the main dilemmas traders and organizations face:

1. Lack of Transparency

AI often operates as a “black box,” meaning its decision-making processes are difficult to understand. Traders can’t always pinpoint why a trade was executed, leading to accountability issues when things go wrong.

2. Algorithmic Bias

AI systems are only as good as the data they’re trained on. If that data is biased, the AI may produce skewed results, unfairly impacting the market or traders.

3. Unequal Playing Field

AI gives a significant edge to those who can afford it, leaving smaller or independent traders at a disadvantage. This raises concerns about fairness in the financial ecosystem.

4. Market Manipulation Risks

AI has the potential to manipulate markets, whether through high-frequency trading or generating misleading signals. Without regulations, this could damage the integrity of financial markets.

Risks of Relying Solely on AI

While the benefits of AI in forex trading are undeniable, relying solely on it comes with its risks.

1. Overreliance is Dangerous

AI is not infallible. Unexpected global events, like pandemics or financial meltdowns, can disrupt the data patterns that AI relies on, leading to poor decisions.

2. Loss of Human Intuition

AI lacks the instinct that seasoned traders bring to the table. Gut feelings about market sentiments or anomalies often lead to opportunities that AI systems miss.

3. Regulatory Compliance Complications

The forex industry is heavily regulated, and keeping AI systems compliant with local and international laws can be time-consuming and complex.

Will AI Replace Human Traders?

The short answer? Unlikely. While AI may dominate repetitive or data-intensive tasks, human traders remain irreplaceable when it comes to interpreting emotions, managing risks creatively, and making judgment calls during unpredictable situations.

AI should be seen as a tool for augmentation, not replacement. The future of forex may lie in a hybrid model where AI handles data-heavy operations, and humans oversee strategic decision-making.

Best Practices for Using AI in Forex Trading

1. Combine AI with Human Expertise

Use AI to assist with analytics and recommendations, but bring human intuition into the decision-making process.

2. Prioritize Transparent AI Tools

Choose platforms that explain how their algorithms work, enabling you to make informed decisions based on AI predictions.

3. Stay Compliant with Regulations

Ensure your AI tools comply with local and global financial regulations to avoid legal hurdles.

4. Educate Your Team

Train your team to understand both the capabilities and limitations of AI systems. This ensures a balanced approach to trading.

Relevant Post

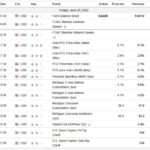

U.S. Dollar Market Moving Data – June 27, 2025 (Real Impact Review)

People Also Ask (FAQs)

Will AI dominate forex trading in the future?

AI will play a significant role in forex trading but is unlikely to replace human traders entirely. It will serve as a powerful tool for assisting with analytics and automation.

Can small traders use AI tools?

Yes. Many AI trading platforms offer pricing plans and even free trials, making these tools accessible to smaller traders.

What are the ethical concerns of AI in forex trading?

Major concerns include lack of transparency, potential biases in algorithms, and inequity in resource availability between large and small traders.

Does AI guarantee profitable trades?

No. AI enhances predictive accuracy but cannot account for market unpredictability, such as black swan events or global crises.

How do I start using AI for forex trading?

Begin with platforms that offer free trials to familiarize yourself with AI features, and ensure you have a basic understanding of forex trading.

The Future of Forex Trading is Hybrid

AI is here to stay, and it’s shaping the way forex trading operates. While it offers incredible advancements in speed, precision, and data analytics, human intuition and strategic thinking remain indispensable.

The ideal future for forex lies in collaboration. By combining AI’s efficiency with human creativity, traders can tackle the complexities of the market like never before. For those looking to harness the power of AI responsibly, now is the time to start exploring powerful trading tools that integrate AI into their processes.

Pingback: Can you really survive just by trading In 2025

satvsi

yhqk5g