Scalping has been a go-to strategy for traders for years. But as we step into 2025, many are asking, is scalping really worth the effort? With rapidly evolving technology, tighter regulations, and new trading tools, the landscape looks drastically different than it did just a few years ago. That’s what we’re here to discuss today—to explore whether scalping is still a viable trading approach and if you should consider it.

From understanding how scalping works to uncovering its benefits and risks, this comprehensive guide will give you the insights you need to decide if it’s the right fit for your trading style and goals.

What Is Scalping?

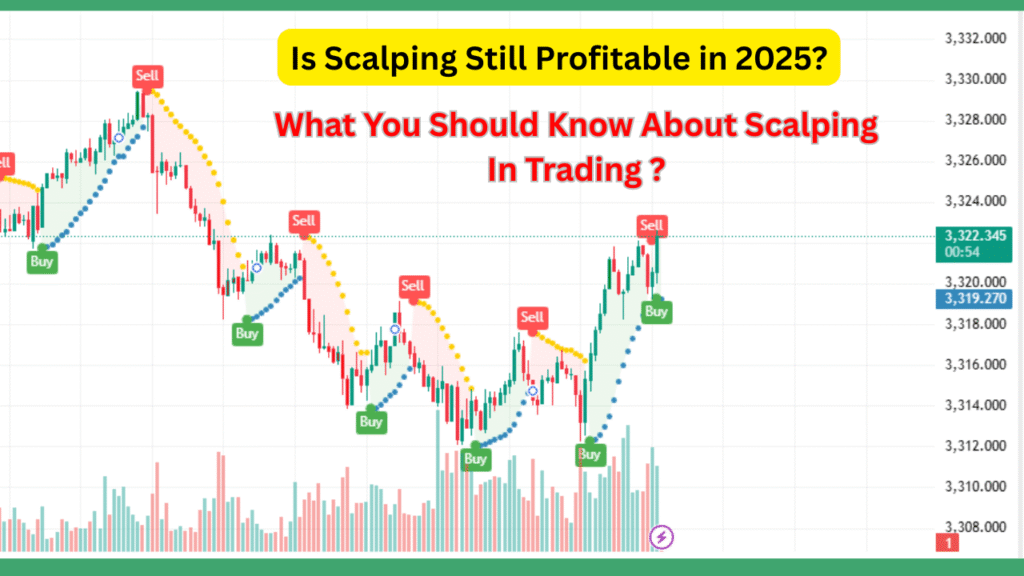

Scalping is a high-frequency trading strategy where traders aim to profit from small price movements. Instead of holding onto positions for hours, days, or weeks, scalpers execute trades within seconds to minutes, hoping to lock in small, consistent profits.

Key characteristics of scalping include:

- Short Time Frames: Trades typically last a few seconds to a few minutes.

- High Volume: Scalpers execute several trades in a single day.

- Small Gains, Consistently: Each trade aims for small profits, often just fractions of a percentage.

But why has scalping gained such popularity? Simple. It’s a quick way to take advantage of market fluctuations without being exposed to overnight risks.

How Scalping Has Evolved

Scalping in 2025 is not what it was 10 years ago. Today, it’s shaped by advancements in technology and shifting financial landscapes. Here’s what has changed:

1. Advancements in Automation

AI and algorithmic trading bots have leveled the playing field (and arguably raised it). With lightning-fast execution and data-driven decisions, these tools make it harder for humans to keep up.

2. Reduced Spreads and Tighter Margins

Broker competition has driven spreads to an all-time low. While low spreads make scalping feasible, they also mean potential gains per trade are smaller.

3. Regulatory Oversight

New regulations across the globe have focused on reducing market manipulation and excessive speculation. Some platforms now impose tighter restrictions on high-frequency trading.

4. Access to Retail-Friendly Tools

On the bright side, platforms like MetaTrader 4, TradingView, and advanced candlestick pattern tools have become highly accessible, even for individual traders.

The Benefits of Scalping in 2025

Despite challenges, scalping still offers unique advantages, provided you approach it the right way.

1. Quick Returns

One of the biggest perks is its immediacy. You don’t have to wait weeks to see results; scalping gives you instant feedback.

2. Minimized Overnight Risk

No need to lose sleep over global market news impacting your positions because your trades don’t last overnight.

3. Opportunities in All Markets

Whether the market is bullish, bearish, or ranging, scalpers can profit in any condition.

The Risks of Scalping

Before jumping in, it’s crucial to understand the risks. Scalping isn’t all profits and quick wins.

1. High Stress Levels

Scalping demands constant attention. If you’re not mentally prepared to monitor screens all day or make split-second decisions, this strategy may not be for you.

2. Large Spreads and Commissions

Even with lower spreads today, the high trade frequency can result in significant fees that eat into profits, especially for retail traders.

3. Execution Risks

Latency (the delay between placing and executing a trade) can affect scalpers significantly. The slightest delay could turn a winning trade into a loss.

Is Scalping Still Profitable in 2025?

The short answer is yes—but with caveats. Scalping in 2025 can be highly profitable if you have the right tools, discipline, and trading strategy. Here are the determining factors of success:

1. Your Trading Tools

Investing in the right tools isn’t optional anymore. Automated trading bots and advanced analytics tools can give scalpers a significant edge in fast-moving markets.

2. Your Market Knowledge

Success lies in identifying recurring patterns, understanding technical indicators, and staying informed about the asset you’re trading.

3. Efficient Execution

A fast and reliable trading platform can make all the difference. Speed, accuracy, and low latency are non-negotiable for scalpers.

Real-Life Scalping Success Stories

Take Daniel, for instance, a full-time crypto scalper. Using tools like TradingView and Binance’s API, Daniel executed over 800 micro-trades in a single month, profiting from Bitcoin’s price fluctuations. His secret? Automating repetitive tasks and sticking to strict entry and exit points.

Or consider Ava, who scalps in the forex market. Ava relies on candlestick patterns and RSI indicators to time her trades. Her approach is simple but highly effective, netting consistent monthly gains.

Scalping Tips to Elevate Your Game

Thinking of giving scalping a go? Here are some pro tips to get started on the right foot.

- Start Small

Practice with a demo account or small trades until you’re comfortable with the fast pace of scalping.

- Master Technical Analysis

Patterns like the Bullish Engulfing and Doji can help you predict price movements with confidence.

- Set Clear Goals

Decide on your risk tolerance, daily targets, and maximum loss limits beforehand.

- Invest in Quality Tools

Automation tools and platforms with low latency can dramatically impact your results.

Relevant Post

Top 5 AI Trading Bots for Forex in 2025

FAQs about Scalping

Q1. Is scalping suitable for beginners?

Yes, but only if beginners are willing to dedicate time to education and practice.

Q2. Which markets are best for scalping?

Forex, cryptocurrency, and stock indices are popular choices due to their high liquidity and volatility.

Q3. What tools are essential for scalping?

Trading platforms with low latency, advanced charting tools, and often, automated bots are essential

Final Thoughts on Scalping in 2025

Scalping remains profitable—but only for those who approach it strategically. The 2025 trading landscape has evolved, making preparation, discipline, and adaptability more critical than ever.

If you’re ready to elevate your trading s

Pingback: Can AI trading bots really make profit In 2025